Sales tax doesn’t apply to freight charges billed directly to the purchaser by a common carrier.Ĭalifornia: For the most part, shipping charges are exempt from California sales tax if the sale is exempt. If a shipment includes both taxable and exempt property, tax typically applies to the percentage of the delivery charge allocated to the taxable property. TPT generally doesn’t apply to freight costs billed to and collected from a purchaser by a retailer for tangible personal property shipped directly from a manufacturer or wholesaler to the purchaser (aka, drop shipments).Īrkansas: Freight, shipping, and transportation are considered part of a sale in Arkansas, so shipping charges are taxable if the products being shipped are taxable and exempt if the products are exempt. Likewise, handling charges for tangible personal property are generally subject to tax, as are combined shipping and handling charges.

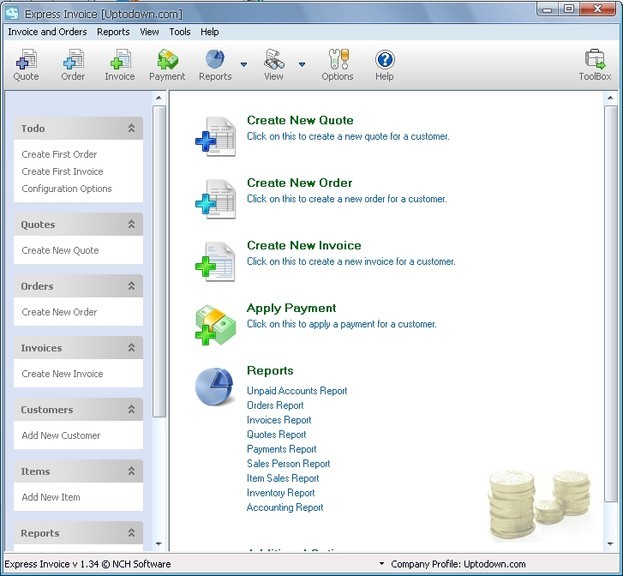

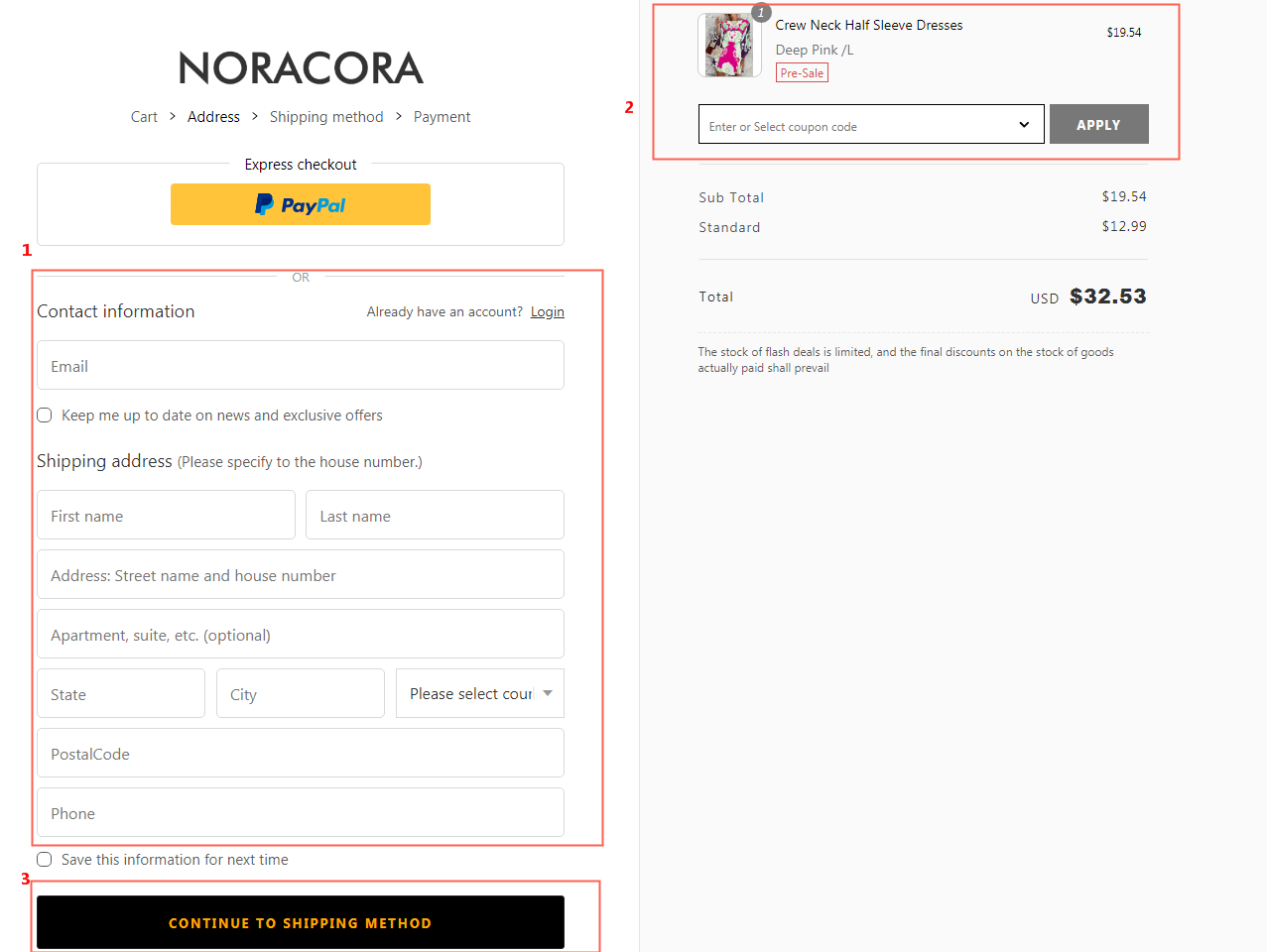

Remove shipping address express invoice code#

Code § 15-5-133, freight costs incurred prior to retail sale are considered part of gross sales and therefore subject to tax. Transportation charges that are included in the sale price are not excluded from tax.Īrizona: Shipping charges are generally exempt from Arizona transaction privilege tax (TPT) if separately stated but taxable if included in the sale price. When made by common carrier or the United States Postal Service (USPS), transportation charges are exempt from sales tax if billed as a separate item (identifiable from other charges) and paid (directly or indirectly) by the purchaser. Please confirm all information with the state department of revenue or a trusted tax advisor.Īlabama: Delivery charges are subject to sales or use tax if the delivery is made in a vehicle owned or leased by the seller. What follows are general guidelines, not tax advice. The following guide provides more detailed information for each state and answers frequently asked questions like, “Do you charge sales tax on items shipped out of state?” or “Is there sales tax on U.S.

If the shipment contains both exempt and taxable products, the portion of the charge allocated to the taxable sale is taxable, and the portion attributed to the exempt sale is exemptīut that’s just the tip of the iceberg.

If the contents of the shipment are exempt, the charges to ship it are typically exempt.If the contents of the shipment are taxable, the charges to ship it are taxable.

Some general rules of thumb for included shipping charges: A combined charge for shipping and handling may be taxed differently from separate charges for shipping and handling. Charges for a company to deliver goods in its own vehicle are often taxed differently than charges for delivery by common carrier or private carrier. Is shipping taxable? Just as there’s no one way to get products into the hands of customers, there’s no one way to tax delivery charges: Taxability varies by state and is influenced by the delivery method, whether the products being shipped are taxable or exempt, and other factors.

Remove shipping address express invoice how to#

Worldwide retail ecommerce sales could reach $6.169 trillion in 2023 and comprise 22.3% of total retail sales. If you’re part of that rising tide, you need to know how to tax shipping and delivery charges.

0 kommentar(er)

0 kommentar(er)